Arbitrage

Table of Contents

Winning Every Time⌗

I’m going to summarize arbitrage sports betting. I think I’m going to add this to “projects” although the artifacts/results of my time spent in this space aren’t really relevant to this post. Also anytime I reference myself, me, or I in this post I’m actually talking about Jonathan

Is that click bait? I’d argue its not because its true, and I don’t make any money or care who reads this so… no I don’t think so.

The scene⌗

In 2021 or 2022 as sports books were rolling out across the U.S. they all had large promotions “Bet $5 get $200 in free bets” kind of thing. This was essentially just free money as there are many places that will freely show you how to optimally liquidate your free bets into cash. If you read through that link you’ll see that what you use is a hedge against your free bet… so

- if your free bet wins you get a nice payout minus your hedge.

- if your free bet looses you get a nice payout from your hedge minus nothing… the bet was free… or the cost of becoming eligible to receive the promotion.

This is all fun and stuff, but I quickly liquidated all the cash out of these opportunities and was left with a crippling addiction… just kidding… but gambling addiction is no joke and extremely sad. I was curious to know if sports books ever mis-priced lines, how lines were created, or if you could pit two sports books against each other…

Background on the books⌗

Online Sports books are no better than playing roulette at a brick and mortar casino. They play on human biases and tendencies toward lottery like payoffs to extract value from players over time. Those who consistently win are banned or limited as value extraction is a one way street.

Sportsbooks typically have well informed lines. A betting line refers to the odds that a sportsbook lists for a wager. There are different ways to display odds. I’m going to specifically talk in American odds just because that’s what I’m used to, not because they are superior in anyway (I think most professionals use decimal odds, but I could be wrong).

In American odds, the favorite is shown with a (-) and denotes the amount of $ you’d have to bet to win $100, if the odds are -400 you’d have to bet $400 just to win $100 meaning that “thing” you’re betting on is likely to happen. If the odds are +400 we are betting on an underdog, in this case, if we bet $100 we’d win $400. We can also determine the implied odds underlying the odds we are being shown.

For example:

+400 could be re-written to note the we are betting $100 to win $500 (We get our $100 bet back + $400 in winnings) -> 100/500 or 20% implied odds. For our favorite at -400 we are betting $400 to win 500$ (We get our $400 bet back + $100 in winnings) -> 400/500 or 80% implied odds.

These lines are constantly updated with the latest information and these books are also keenly aware of the action that is occurring on a particular line. I won’t go into detail here but this article has info on how books manage risk on specific lines.

So are we just going to look for lines that are “off”: This team should only be a +200 underdog but the book has them at +500? Given this information above, we are unlikely to catch sports books utterly mispricing a particular line… but maybe we can catch them being just so slightly off. We also have to remember that because these books are just extracting money from people there is a lot of competition to be an extractor. What I mean is that there are a lot of ways to gamble on sports, even Robinhood has begun adding basic predictions markets on sporting events. When all of these different places offers odds on an outcome; sometimes, they begin to disagree with one another. This is what we can take advantage of.

Taking both sides⌗

What do I mean by “pit books against each other”. To explain this I want to walk through how these books function.

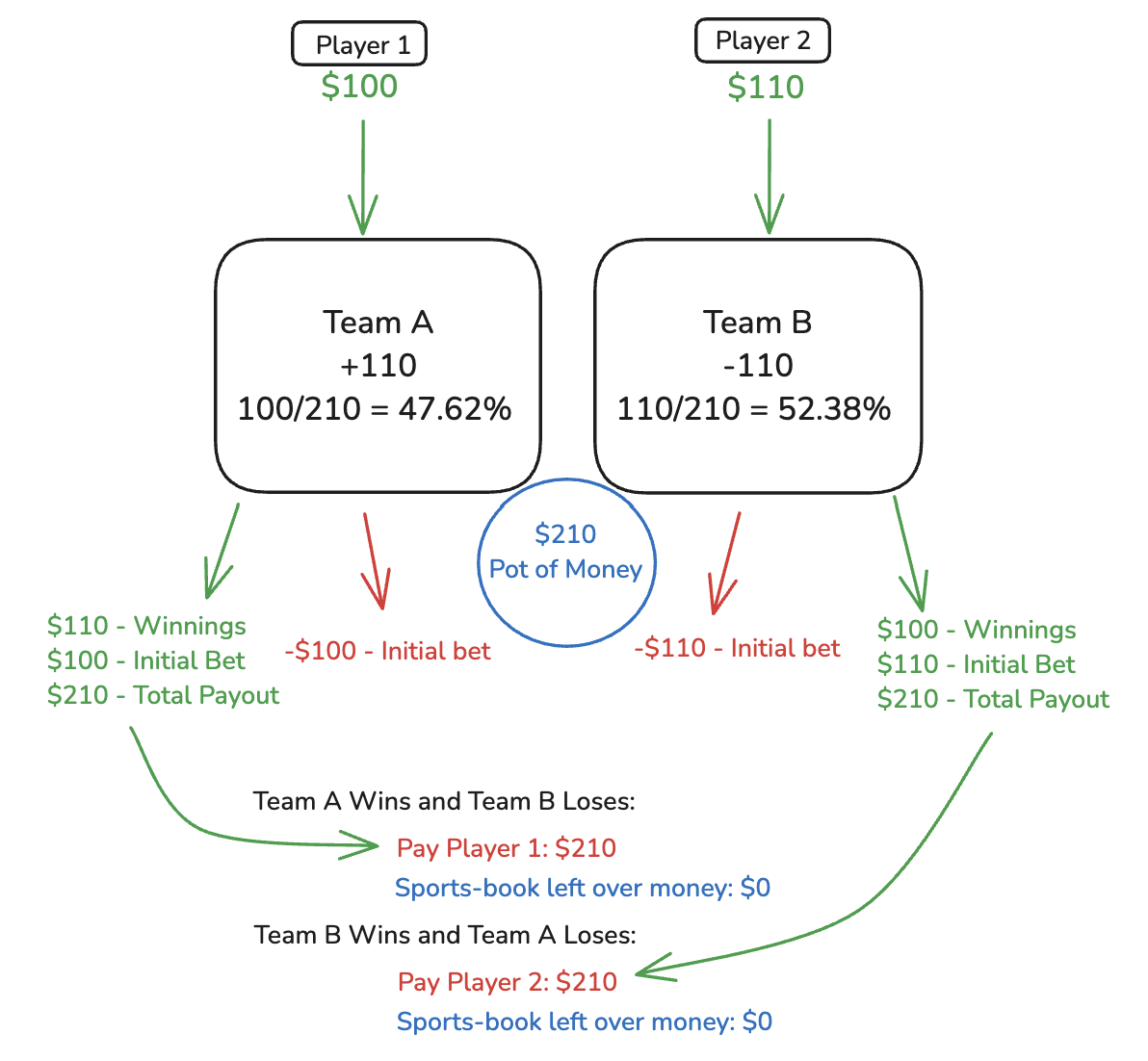

We are going to be a sports book for a second. Lets say sports team A is playing sports team B. At our book we think this is going to be a close match so we offer team A at +110 (slight underdog) and team B at -110 (slight favorite). I play the scenarios out in the below drawing.

Two players one on either side of the line place bets so that their total payout is equivalent ($210):

You can see our sports book makes no money regardless of the out come (It’s pot of $ generated by the players must be payed out in full to satisfy the bets regardless of the outcome), its just facilitating transactions, and it’ll be in the red after it has to pay its variable/fixed costs. This is why you’d never see these odds at a sports book outside of gimmicks like the Super Bowl coin toss, promos, etc… You’ll see lines like this:

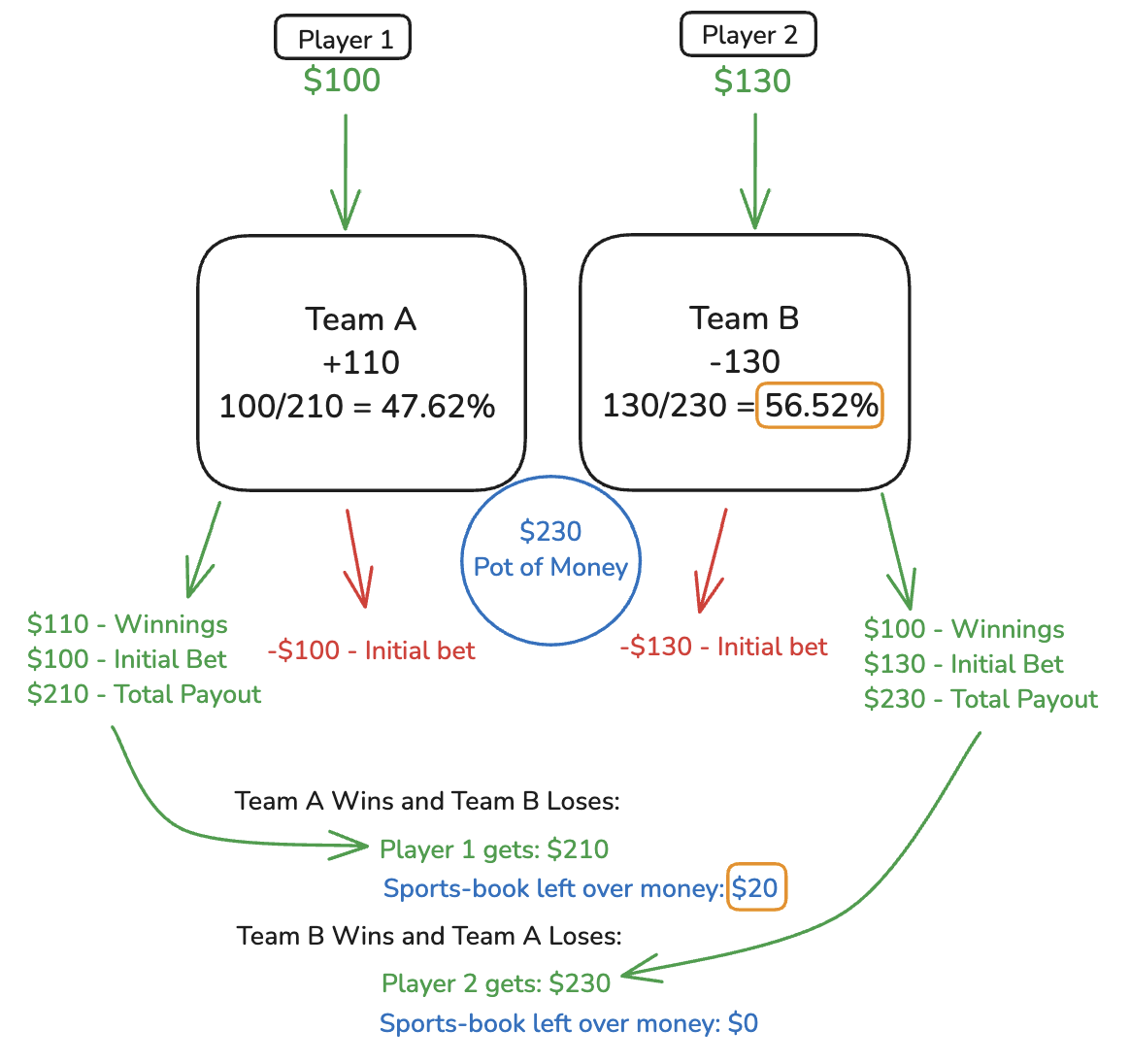

What changed? The odds on Team B went from -110 to -130 (It became more of a favorite, a.k.a the sports book pays out less money on the same amount wagered). Previously, player 2 only needed to bet $110 to win $100 now they have to bet $130 to win $100. I added the implied odds of the specific outcome in the first diagram with a 47.62% chance our underdog wins and a 52.38% chance our favorite wins. These sum to 100%.

Now lets check out the implied odds in the +110 / -130 scenario… 47.62% and 56.52% respectively… these don’t sum to 100% anymore, now we get (104.14%) uh oh. NOW our book is making money:

- if team A wins the books makes $20

- if team B wins the book breaks even.

- We calc the EV here assuming the true odds are -110/+110 as (.4762 * $20) + (.5238 * $0) =

$9.52

Wow so our book has an EV of $9.52 every time two people put on this bet! And looking at little further if we divide our EV by the Pot of money: $9.52/$230 we get ~4% remember our new totaled implied odds 104.14%… 104% - 100% = 4% this is the books “hold”. Hold in sports betting refers to the percentage of money that sportsbooks keep for every dollar wagered. The percentage will vary by wager type. Sportsbooks can’t just maximize hold because they have… competition. If I can get +130 in book A where as book B offers +150 on the same bet… you’re going to bet with book B every time… sports books need volume they need your bets to make money.

And this is what these books want, they want as high volume of these transaction as they can get. That’s why they put on promotions and offer free bets and create Ads with tigers and famous people etc…

But do all books have the same odds? No. Just as books create lines that ensure they win, we can look for favorable lines as well. These books don’t exist in a vacuum they compete against each other for a pool of betters, many of which are sensitive to how great of a hold a book has on a particular line. As sports books update their lines, mis-price things, or disagree with each other we can take advantage. Lets look at this below.

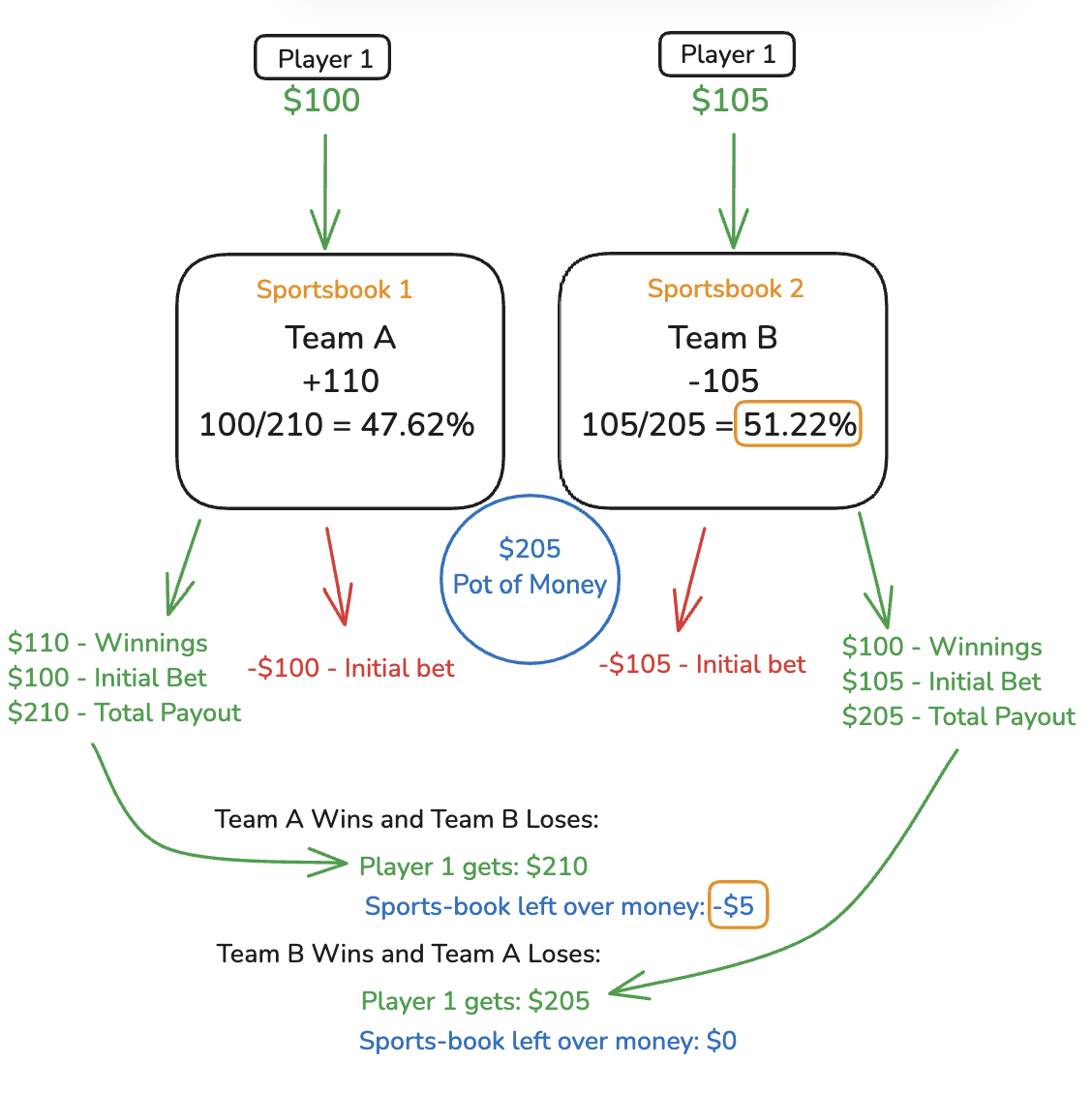

In this scenario the same player is taking both sides of a line across two sports books. Sportsbook 1 offers +110 while sportsbook 2 offers the other side at -105. Lets look at what happens.

Bam and now we can see that no matter the outcome of this game, player 1 makes $5 or comes out even. Summing the implied odds 47.62% + 51.22% = 98.84% we have engineered an inverse hold (1.16%), where the player always comes out on top regardless of the outcome. Our EV on this bet, assuming true odds of +110/-110 is (47.62% * $5) + (52.38%* $0) = $2.38 and don’t forget $2.38/$205 = 1.16% (Our inverse hold).

Wow so if I have $205 I can instantly make 1.16% on it if I can find these lines?

- Yes

And if you take that same $205 and use it again and again every night for a month I could make even more $?

- Yes

And if I increased my bet sizes to $10,000 could I scale up the magnitude of my profit?

- Yes, in our contrived +110/-105 example if we bet $10,000 on +110 and $10,500 on -105 we’d have an EV of (47.62% * $500) + (52.38%* $0) = $238… I like $238 better than $2.38.

What if we found something even better like +110/+110?

- Yes that would be nice.

So what’s the catch?⌗

-

Books aren’t dumb, they will see you are consistently hitting soft/slow lines.Lines with low hold or lines that weren’t updated fast enough to avoid mis-pricing across other books. They will ban you or limit you to only being allowed to bet a few dollars at a time. -

It’s harder than you think to find these odds. Odds scraping is difficult. Scaling is hard.If you buy odds… that’s going to cost you $, and they are slightly delayed. You are going to struggle to place bets via an api, most books don’t have one, so you’re going to have to build something to place these bets via the UI or manually do it (Doesn’t scale well). -

Odds can change as you take both sidesas there will inherently be some latency between the two bets. If they change in the wrong direction and you already have exposure to one side… now you’re just trying to limit your losses. -

I said before that books will limit you, they can also void your bet.That’s right, if the sportsbook realizes it gave you too good of odds it will just void the bet. Bad analogy alert: Imagine you open a 12 month CD at 4.5%, sign the paper, add the money done… you wake up the next day and the CD isn’t there any more. You call the bank… “Yeah umm we actually don’t want to give you 4.5% so we closed the account… how about 3%”. Sports books can and do just that… remember you are on their platform and this stuff is relatively “new” they get to do what they want (to a point) with little recourse. Its like if you build a YouTube channel and they strike down your video… you can try and appeal but at the end of the day you’re on their platform and play by their rules wether or not your video was justifiably taken down. And who is to determine justifiably? I don’t know that’s a topic for another day. -

Books will ban you.Internally it’ll be called the fraud detection team or money laundering blah blah blah, and I’m sure they do a good amount of that… but in reality its the smart money detection team “don’t let us lose money at all costs if someone wants to win they can do it elsewhere.” -

In the United States there is this thing called death, and there’s this other thing called taxes…both tend to happen to people. Speaking of taxes, there is another thing called taking the standard deduction, and there’s other things about qualifying as a “professional gambler”. Now what do all these “things” mean? I don’t know, I am not an expert but you should READ UP ON THIS before you start your lucrative arbing at scale. -

Side note, Arbitrage exists in other markets as well, look at the trades SBF was putting on back in the day.

- Here SBF is taking advantage of price differences between markets (buy low, sell high), his major challenges were essentially bridging the two markets. If people were willing to sell BTC for $10,000 and others willing to buy it for $15,000 in a single efficient market the prices would converge and the opportunity would be quickly eaten up. But because there was a lack of information, hurdles to cross in putting on the trade, and crypto being the wild west he was able to capitalize on this opportunity.

So if we could overcome all the issues above (I’m sure some people do) we could generate a nice profit. But it is NOT easy to do, NOT easy to remain undetected, and NOT something you could accomplish over night. You WILL need $ to get started, you WILL need to adapt to changes and you WILL run into issues as you scale.

Good luck.