Robinhood Gambling

Table of Contents

The Robinhood gambling factory⌗

Robinhood has a nice mobile experience, they have good products/deals, and they also have a credit card.

There has been a lot of talk about Robinhood engaging with human “gambling instincts”.

Just search “how has Robinhood gamified investing” and you can watch confetti rain down as someone yolos their life savings into GME 0 DTE calls

Again, I’m not saying the product is all bad, but there is one piece which is astonishingly ridiculous to me.

The Credit Card⌗

I’m not going to write about the Casino-like aspects of the brokerage product… but there is also the Robinhood CREDIT CARD!

I opened the card a few months ago, payed the $50 Gold annual subscription, applied, and got the card. The card is kind of nice… the gold is a little gimmicky, but the 3% back on everything and 5% on travel is good for someone that doesn’t want to swap cards around for each kind of purchase.

I can just nail down 3%, convert those points to cash that lands straight back into Robinhood, and earns 4% APY. Am I leaving a few bps on the table… sure, but everything is contained in the same ecosystem, transfers are fast, and 4% APY on my uninvested cash is fine.

The Mystery Box⌗

For the first time, I go to exchange my points for cash, 1 point = 1 cent. I’m not going to fuss around with gift cards/shopping stuff, I want my cash, and I want to go make 4% on it.

After opening up the rewards tab, I’m forced to scroll ALL THE WAY TO THE BOTTOM to get to the “Cash Back” section. I’m scrolling through shop with points, travel with points, buy Robinhood merch with points and Low and Behold I see “The Mystery Box”… what the fuck is “The Mystery Box”.

Well, I’m glad you asked, and you can retrieve the full details here… but, in short, the Mystery box is LITERALLY an online casino.

That’s right, You can shuttle 1000 points (~$10) into this thing and come out with… less than $10! Amazing, lets break it down.

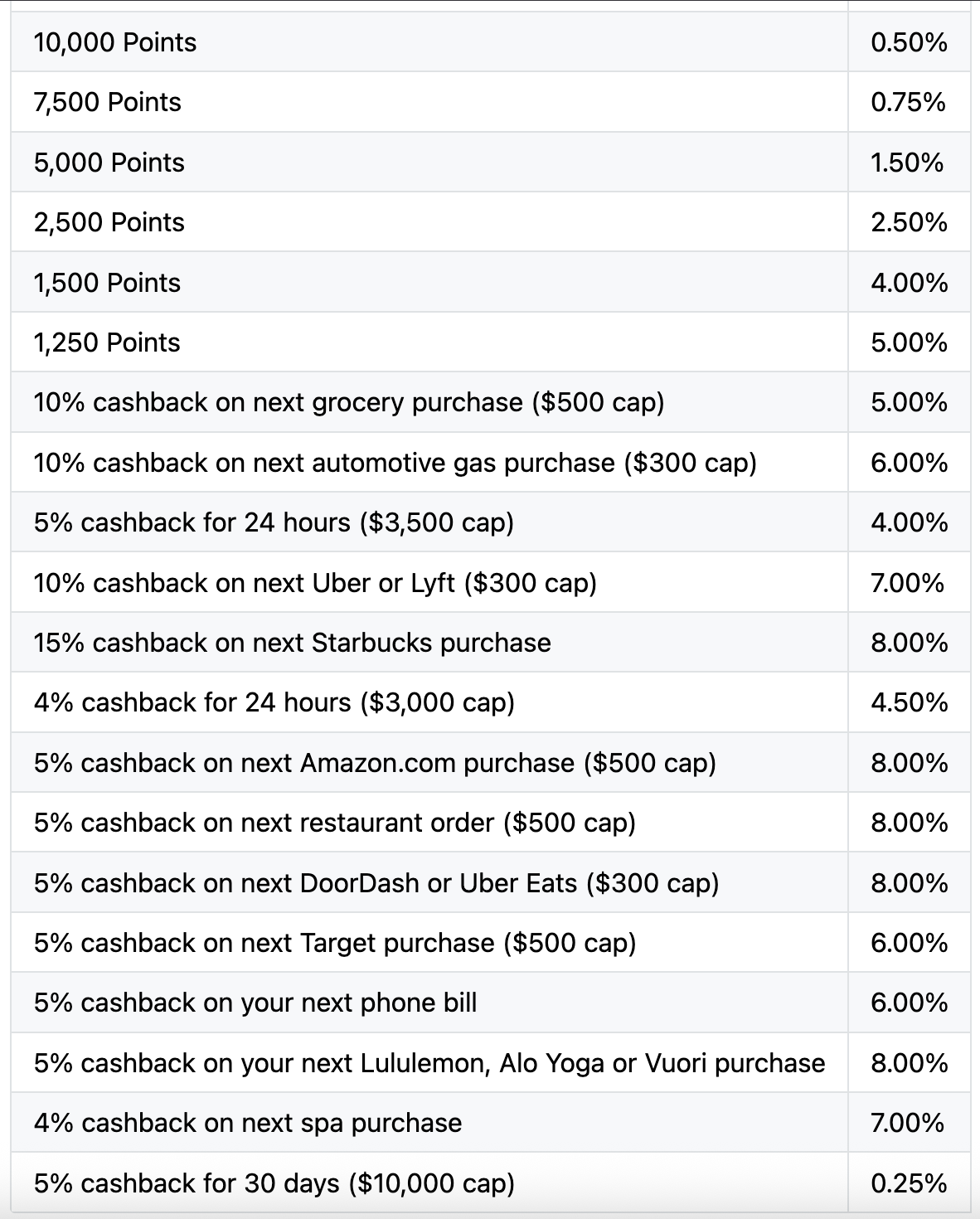

A few things to start, the odds do sum to 100%, so you’re guaranteed to win one of these things. Each win is independent and the odds don’t change as far as I can tell. So lets look at expected value:

“Cash” Prizes:⌗

- 10,000 Points @ 0.50%: 10,000 Points = ~$100, $100 * 0.50% = 50 cents

- 7,500 Points @ 0.75%: 7,500 Points = ~$75, $75 * 0.75% = 56.25 cents

- 5,000 Points @ 1.50%: 5,000 Points = ~$50, $50 * 1.50% = 75 cents

- 2,500 Points @ 2.50%: 2,500 Points = ~$25, $25 * 2.50% = 62.5 cents

- 1,500 Points @ 4.00%: 1,500 Points = ~$15, $15 * 4.00% = 60 cents

- 1,250 Points @ 5.00%: 1,250 Points = ~$12.50, $12.50 * 5.00% = 62.5 cents

Total EV: $.50 + $.5625 + $.75 + $62.5 + $.60 + $.625 = $3.6625

Hmmm… I hope we catch up a little bit on the cashback prizes.

Cashback Prizes:⌗

A few notes on cashback:

- We must factor in the fact that we would have earned 3% on these purchases anyway, thus, we have to take cashback% minus 3% to calculate the true net benefit

- To maximize the value you must spend up to the cap. This means you must WANT to purchase from where you win and be LIQUID/WILLING enough to make said purchase e.g. spend $3500 in the next 24 hours.

Assumptions:

-

I’m going to assume the opportunity cost of capital is $0, this is especially generous as the $500 you spend at Target could be used for investing in 0 DTE options on… Robinhood!…

-

For prizes with no Cap, I’m going to assume average cost (if I can find it) + 25%, otherwise just going to insert a reasonable guess

-

For prizes with a Cap, I’m going to assume the reward is maximized

-

I’m going to assume the above conditions hold for 33% of the items below. This is a big assumption, but it is fair given the variety of options and the previous conditions. This means we’ll cut our EV calculation for this section in 1/3 when it’s all said and done.

Disagree with my assumptions? I simulated the whole thing so you can test for yourself and see if it’s worth it for you. This is actually ripping the rewards straight from api.robinhood.com (and doing so poorly), so it will inevitably break at some point, but it’s fun for now!

-

10% cashback on next grocery purchase ($500 cap) @ 5.00%: $500 * (10-3)% = $35 * 5% = $1.75

-

10% cashback on next automotive gas purchase ($300 cap) @ 6.00%: $300 * (10-3)% = $21 * 6% = $1.26

-

5% cashback for 24 hours ($3,500 cap) @ 4.00%: $3500 * (5-3)% = $70 * 4% = $2.8

-

10% cashback on next Uber or Lyft ($300 cap) @ 7.00%: $300 * (10-3)% = $21 * 7% = $1.47

-

15% cashback on next Starbucks purchase @ 8.00%: $25 * (15-3)% = $3 * 8% = $.24

-

4% cashback for 24 hours ($3,000 cap) @ 4.50%: $3000 * (4-3)% = $30 * 4.5% = $1.35

-

5% cashback on next Amazon.com purchase ($500 cap) @ 8.00%: $500 * (5-3)% = $10 * 8% = $.80

-

5% cashback on next restaurant order ($500 cap) @ 8.00%: $500 * (5-3)% = $10 * 8% = $.80

-

5% cashback on next DoorDash or Uber Eats ($300 cap) @ 8.00%: $300 * (5-3)% = $6 * 8% = $.48

-

5% cashback on next Target purchase ($500 cap) @ 6.00%: $500 * (5-3)% = $10 * 6% = $.60

-

5% cashback on your next phone bill @ 6.00%: ($141 * 1.25) * (5-3)% = $3.525 * 6% = $.2115

-

5% cashback on your next Lululemon, Alo Yoga or Vuori purchase @ 8.00%: $300 * (5-3)% = $6 * 8% = $.48

-

4% cashback on next spa purchase @ 7.00%: $300 * (4-3)% = $3 * 7% = $.21

-

5% cashback for 30 days ($10,000 cap) @ 0.25%: $10000 * (5-3)% = $200 * .25% = $.5

Starbucks, Lululemon, Alo Yoga or Vuori, and Spa purchases I think are fair estimates. The phone bill at least has a source. Feel free to throw some different estimates in there and test it out for yourself.

To find the total EV, we will sum the individual values:

$1.75 (Grocery)

$1.26 (Gas)

$2.80 (5% for 24h)

$1.47 (Uber/Lyft)

$0.24 (Starbucks)

$1.35 (4% for 24h)

$0.80 (Amazon)

$0.80 (Restaurant)

$0.48 (DoorDash/Uber Eats)

$0.60 (Target)

$0.2115 (Phone Bill)

$0.48 (Lululemon etc.)

$0.21 (Spa)

$0.50 (5% for 30 days)

And get: $12.9515 which we can divide by 3 to get $4.3172.

Adding this to our cash prizes, we expect an EV of $3.6625 + $4.3172 = $7.9797!

$10 in… $7.9797 out. You can play around with the assumptions but unless you’re ready to maximize every single one of the Cashback prizes… every single time you roll the dice on this Mystery Box you’re handing $2 back to Robinhood in the form of them not having to pay out the true value on their 3% rewards program.

This is the definition of a Casino. Robinhood will argue that the program is more than fair as it’s positive EV for someone willing to maximize every single one of these rewards. We can go around in circles about this, but if you land on the 5% cashback on next DoorDash or Uber Eats ($300 cap) @ 8.00% the maximum value one can accrue is .02*300 = $6…

Funny Thoughts (This is not legal or financial advice)⌗

Ok so there are three uncapped offerings:

- 4% cashback on next spa purchase

- 15% cashback on next Starbucks purchase

- 5% cashback on your next Lululemon, Alo Yoga or Vuori purchase

Now if you haven’t head of Konstantin Anikeev let me introduce you. Konstantin curated this beauty:

-

Purchasing Gift Cards: Using his American Express 5% ‘cash back’ Rewards Program, he Purchased Visa gift cards at grocery stores or pharmacies where the 5%Rewards applied.

-

Although Visa cards cannot be converted to cash, they can be used to purchase Money Orders. He would purchase the Money Orders with the Visa gift cards.

-

Deposit the Money Orders to his Bank Account.

-

Pay the Amex Balance.

-

Repeat to the tune of $6.4MM in purchases and $320,000 in ‘profits’ by converting has 5% cashback in excess of fees

There’s also an interesting tax ruling in Konstantin Anikeev v. Commissioner, but this should now draw your eyes to that uncapped 15% starbucks purchase. The 5% and 4% uncapped offerings are interesting, but 15%…

Lets say we call up Starbucks and tell them we have a $20,000 limit on a card paying 15% on our next purchase, how could they turn down this opportunity. Better yet, what if Starbucks wanted to outfit a few stores in Lululemon and Lululemon wanted to buy starbucks for its employees… we could facilitate this trade, in which case I’d be hitting the mystery box like crazy.